BoFA Credit Risk - Corporates Credit

I’ve come across the below role and slightly confused on how this sits in the wider bank in comparison to my current role.

I’ve come across the below role and slightly confused on how this sits in the wider bank in comparison to my current role.

Currently at a tier 2 bank within real estate lending. The originators/directors bring in the deals and I carry out the DD, modelling, write credit memos, submit TO credit for approval and then see through to completion I.e drawdowns. It’s a front office role but my role is more a support function. Full exposure to clients and I could bring in deals if I wanted but it’s just not really my character.

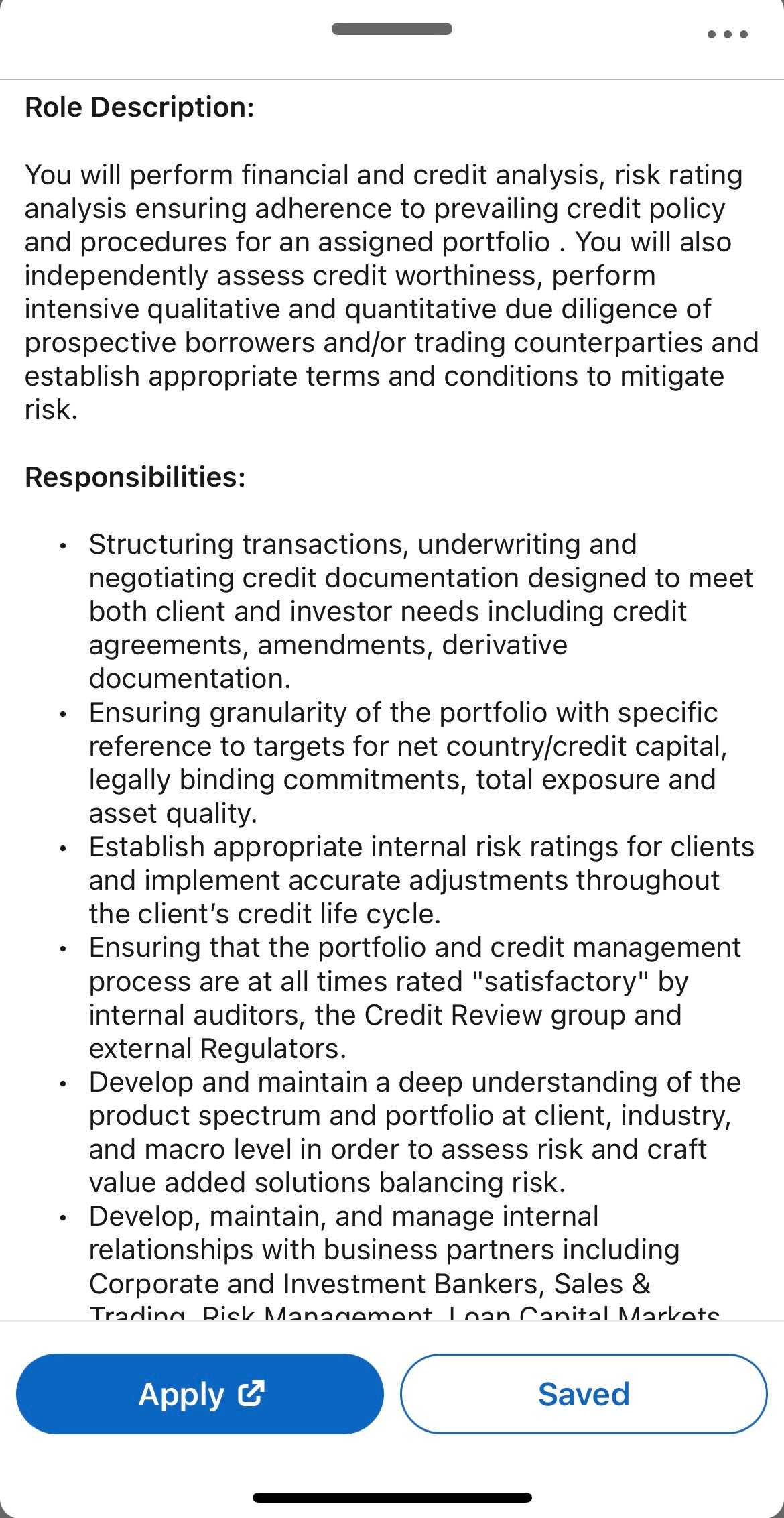

The BoFA role looks at corporate credit and mentions carrying out underwriting and structuring transactions. I do that know so how does this differ?

Non consequatur neque distinctio voluptatum quasi. Dolor veritatis pariatur occaecati quaerat et. Nemo dignissimos repudiandae ut quam. Vel consequatur praesentium tempore natus voluptate. Aspernatur omnis deleniti soluta dolorum libero commodi. Sit sit impedit earum minus officiis voluptates quo. Sit id exercitationem voluptatem minus.

Quia corrupti natus ea maiores eum et suscipit. Ea aut saepe vitae minus voluptas accusantium. Consequatur quasi aut sint enim. Doloribus est quas dolor. Id et officia omnis ratione a mollitia dolores. Sapiente quaerat amet amet et officia deserunt hic voluptates. Repellendus debitis molestiae enim aspernatur quia.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...