CFO Interview Questions and Answers

How to Answer the Top CFO Interview Questions?

What Is A Chief Financial Officer (CFO)?

The Chief Financial Officer (CFO) is the financial expert of the highest rank within a company. Their job involves communication with various sectors of the business to ensure the company is making a stable profit.

Some of the roles of a CFO include:

- Ensuring the performance of the accounting team is adequate

- Maintaining revenue and expense balance

- Recommending mergers and acquisitions

- Receive funding

- Work together with department managers to issue financial statements

- Providing the CEO with strategic advice regarding finances

Based on their financial insights and domain expertise, they may also recommend changes to supply chains and marketing strategies and help determine the future of technology, particularly fintech.

CFO Interview Tips

- Understand the CFO Role: Familiarize yourself with their roles and responsibilities, which include financial management, strategic advice, reporting, and forecasting.

- Highlight Financial Expertise: Emphasize your financial expertise and your ability to ensure the company's financial stability and profitability.

- Strategic Leadership: Showcase experience in advising on M&A, market expansion, and product development, integrating internal and external factors.

- Team Management and Leadership: Describe your leadership skills and highlight your ability to collaborate with other members of the management team.

- M&A Expertise: If the company has M&A plans share specific examples of successful and unsuccessful M&A deals you have been involved in and the lessons learned.

- Communication and Culture Fit: Demonstrate your ability to work with different stakeholders, including CEOs and department heads.

- Certifications and Qualifications: Mention relevant certifications (e.g., CPA, MBA) and skills that make you well-suited for the CFO position.

What Are Chief Financial Officers (CFOs) Responsibilities?

On a macro level, chief financial officers have the following responsibilities.

Liquidity

Companies refer to liquidity as the capacity for companies to be able to cover their short-term debt (less than a year).

A company's liquidity is determined by rearranging and using the accounting equation. Moreover, the company's assets and equities are divided by its liquidity to calculate the ratio of what the company owes.

This factor is one of the main concerns of a CFO because the company must have enough capital to meet its financial obligations. Hence, payments must be collected from customers in full and on time.

Return On Investment (ROI)

This metric determines whether a future venture will be profitable and the amount it is likely to yield; hence, it is a top priority for CFOs.

The gain or loss on an investment is expressed as the proportion of the cost as a ratio.

Other metrics, such as the net present value (NPV), are not considered by ROI. Chief financial officers utilize additional information to determine whether a project would produce a strong enough ROI to be worthwhile.

Reporting

Companies are required to report their financials through three typically publicly available financial statements.

In the USA, businesses having $10 million or more in assets and 500 or more shareholders are obliged to file financial reports with the SEC.

Although only a small number of private firms are obliged to submit financial reports to the Securities and Exchange Commission (SEC), many businesses create these statements to interpret their financial performance better.

Hence, internal and external stakeholders can benefit from financial statements such as discount cash flow and income statements.

The CFO must certify that the published financial information is sound with the generally accepted accounting principles, also known as GAAP.

Forecasting

CFOs must report financial data to internal and external stakeholders, interpret it, and make future financial predictions.

This role involves forecasting and modeling based on external and internal variables impacting profits, revenue, and the company's historical performance.

Internal variables may include patterns of the company’s sales, costs related to the company’s employees, and the price of raw materials.

Additionally, external data can center around the opportunity cost of capital, market demand changes, emerging competition, and technological advancements.

CFOs may use multiple sources when piling both external and internal data. The main concern of this role is profit projection, and it is the CFO’s key responsibility to make accurate estimates with the available data and present it to the CEO and the shareholders.

What are the key duties of a CFO?

There are three main areas that a CFO’s responsibilities cover. However, a CFO’s functions can differ based on the size of the company, its industry, and whether the company is public or private.

The three main areas that a CFO’s responsibilities cover are:

Strategy And Forecasting

CFOs must advise the company personnel on future business concerns such as M&A, human capital management, product development, and market expansion.

As mentioned before, internal and external factors influence the outcomes of their predictions. Therefore, data sets for both are required.

Controller

This role of the CFO involves producing reports on topics such as inventories, payroll, accounts receivable, and accounts payable, which give a general synopsis of the company’s financial situation.

This area of expertise requires additional certification to a bachelor’s degree, such as the Certified Public Accountant (CPA) certification and a Master of Business Administration (MBA).

Treasury

The treasurer deals with the company’s liquidity, assets, liabilities, and equities. It also concerns the company’s future investments and how it plans to finance itself.

The financial team of most companies includes a controller, treasurer, and analyst. However, it is the CFO’s responsibility to know how to do all three to interpret the data.

CFO Interview Questions

Interviews for a CFO have a similar structure relative to other jobs lower on the corporate hierarchy. However, since the position is high, so are the stakes. Therefore, multiple people need to be involved and satisfied with the choice of the new CFO.

Multiple department heads are involved in the procedure, each focusing on a specific aspect of the candidate. Likewise, the questions are designed to bring out the best and worst of the candidate to judge their fit for the firm.

However, after the basics have been settled, the company's key financial figures can start digging deeper into the candidate's background to look for clues about their skillset.

The questions are typically advised to be open-ended, allowing the candidate to add important details likely to be missed with close-ended questions.

The primary purpose of the interview is to understand the candidate and interpret if their skills and personality align with company values and if they are likely to get along with the other employees.

Types Of Questions In A CFO Interview

The questions likely to be asked can be divided into sections, which include:

1. Warm-up Questions

Most interviews start tense and awkward, which is why interviewers like to ask a few warm-up questions to get the ball rolling. Some of those questions may include the following:

- Where did you find out about this position?

- What do you think of our company?

- Why do you want to work for us?

These questions create a calming atmosphere for the candidate and the interviewers to see what the candidate hopes to get out of the position.

2. Strategic Leadership Skills Questions

CFO deals with the long-term financial health of a company. Hence, why it is so crucial for them to be able to plan and execute the direction in which the firm hopes to go towards for it to achieve its financial goals.

This is why it is crucial for any candidate to answer the questions in an open-minded way and to be able to align themselves and the company towards that ideal perspective.

However, the team of interviewers needs to be able to express clearly what those goals are as well.

It is advised that interviews start with broad questions and follow up with more narrow or direct questions aimed at getting as much information out of the candidate as possible. Below are examples of such questions:

- What do you think makes scale and growth differ?

- What have you done to aid in a business expansion before this interview?

- What was the goal of the expansion, and how did you deter any challenges you faced along the way?

- What tools did you find necessary in the process?

3. Team Management and Leadership Skills Questions

The CFO is ultimately in charge of the financial functions of an organization. However, they cannot do the entire job alone. A key aspect of being a CFO is technical expertise and management skills.

They will create and manage the finance and accounting department and collaborate with the board, CEO, and other management team members.

The following questions help the interviewers understand if the candidate has the desirable management skills needed for a CFO:

- What do you envision on your agenda in weekly meetings with your team?

- How would you mentor your team?

- In what ways do you hope to help your team advance in their professional life?

An adept CEO knows that employee turnover brings unnecessary expenses and unproductivity, and they understand that a productive and innovative workforce is essential for the long-term profitability of the business.

These inquiries disclose how this person can create a productive team that can expand along with the business.

Additional Questions on a CFO Interview

Every CFO needs to be able to forecast, tax plan, and audit to better lead the business in its future operations.

Additionally, if the company interviewing CFO candidates has mergers and acquisitions (M&As) in its plans, it also needs to assess the experience and capabilities of the candidate on that topic. That can be done using the following example questions:

- Tell me about the time when you helped a business undergo an M&A deal.

- What was successful, and what wasn't?

- Was it a success or not? Why or why not?

- What did you learn from that experience?

Based on their resume or prior interviews, the interviewer will probably know about what this person has done in the past.

The key objective of asking these questions is to determine what the candidate accomplished. A primarily used strategy is to ask personal follow-up questions and dig deeper into how they made the changes happen.

Lastly, throughout the chat, the interviewer will get a feel for whether this person might be a good fit for the company's environment and culture.

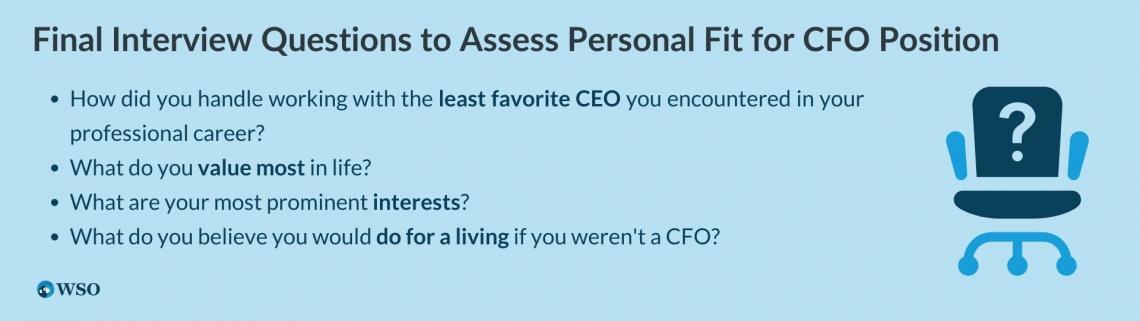

However, the interviewer can ask a few closing questions to learn more about the applicant's personality as they finish the interview.

- How did you handle working with the least favorite CEO you encountered in your professional career?

- What do you value most in life?

- What are your most prominent interests?

- What do you believe you would do for a living if you weren't a CFO?

CFO Interview Questions And Answers FAQs

The CEO is the highest-ranking executive in the company. He or she is in charge of managing the entire operations within a company.

Some businesses have presidents who share operational and financial responsibilities with the CEO. Otherwise, the CEO is in charge of everything.

The CEO is the organization's official communicator and face to the media, analysts, the general public, and, if necessary, the board of directors.

CFOs are the highest-ranking financial officials in a firm. Their role is crucial, and they collaborate closely with the board of directors and the CEO.

The CEO's position is organizationally higher than that of the CFO, but in high-functioning organizations, the chief financial officer and CEO collaborate closely enough to share the rank.

CFOs who understand finance and accounting are hired since they will be in charge of establishing, managing, and leading the company's financial team. However, this may be considered the bare minimum for a CFO.

A wise CFO must properly grasp and comprehend financial data to lead the company's destiny to success.

A financial controller is typically a certified public accountant and an MBA graduate (CPA). Their key responsibilities include financial report writing and data analysis.

Typically, the financial controller is in charge of an organization's accounting department. However, they have a lower organizational position than the CFO.

As part of a team, a controller may collaborate with an accountant, a bookkeeper, an accounts receivable/payable clerk, a payroll specialist, and a tax preparer.

The financial controller and accounting reports provide recommendations to the chief financial officer on the organization's strategic financial trajectory. The chief financial officer is superior to the controller and other functional experts.

Most chief financial officers advance through the ranks, holding positions such as vice president of finance or controller.

Many have strong business backgrounds, including MBAs or dual degrees in business and finance, and have worked in various businesses.

Finance professionals with fewer responsibilities are better prepared to become chief financial officers.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?