Investment Banking Salary Guide

Provides salary information for different positions in the industry, helping individuals understand earning potential and benchmark salaries

Investment Banking Salary Guide

Investment banking is a lucrative profession. It's not just about the pay either. Investing in your career can help you build a personal brand and increase your industry knowledge. However, it comes with a steep learning curve that can be intimidating for some.

A Salary Guide is a resource that provides information about typical salary ranges and compensation structures for various job positions within a specific industry or profession. It offers insights into how much professionals in different roles can expect to earn based on factors like:

- Experience

- Location

- The type of employer

An Investment Banking Salary Guide, specifically, is a salary guide tailored to the field of investment banking. It provides information about the typical salaries and bonuses for various positions within the investment banking industry.

This guide may include data on roles such as analysts, associates, vice presidents, managing directors, and other professionals working in investment banking.

It can offer insights into how compensation varies based on factors like the size of the investment bank, geographic location, and the employee's level of experience.

There are a lot of careers within financial services, there are a few name:

- Asset management

- Private equity

- Sales and trading

So how do I decide if investment banking is for me? If you like working with lots of data or numbers, and enjoy company valuation, then this is the career for you. Also, if you're very math-oriented and hard-working, you will enjoy a career in investment banking.

Pay can be a determining factor when deciding which career to pursue. However, comparing compensation from different firms can also be difficult. If you're considering investment banking as a career or thinking about changing jobs in the industry, then this article is for you.

Key Takeaways

- Several factors impact an investment banker's salary, including experience, education, location, and industry. More experience and higher education levels often result in higher salaries.

- Investment banking bonuses are influenced by firm type, team performance, and bank performance. Top performers may receive bonuses equal to their base salary, while lower performers get a smaller percentage of their base pay.

- Investment banks are categorized as bulge bracket, elite boutique, or middle market. Each type offers different base compensation levels and bonus structures.

- The year-end bonus for investment bankers is predicted to decrease in 2023 due to a slowdown in M&A deals and economic uncertainty. Many banks are raising base salaries to attract and retain talent.

Factors Affecting Salary

Several factors affect the salary you'll earn as an investment banker. In general, wages will be higher if your experience and education levels are greater. The amount of money you'll make also depends on where you work.

A typical starting salary for a first-year investment banker would be in the $60,000 range. However, as with any industry, there are also other factors to consider when it comes to compensation:

1. Experience

The more experience you have, the more income you'll likely make. Investment banks are typically structured in a military-like hierarchy: analyst, Associate, vice president, and managing director.

Because the risk you take on increases with each higher-up position, the compensation increases significantly.

To succeed in this career, a banker must know the industry well. However, this experiential knowledge only comes with having worked in this occupation for a substantial time.

So if you're a recent college graduate just starting in the industry, you'll likely have a smaller role and be paid less than someone with 10-15 years of experience.

However, you may take less than five years to earn what another experienced banker earns in just one year. If that's the case, going for a shorter term could pay off to boost your salary significantly.

2. Education

The higher your degree level, the better chance you have of earning a higher salary than someone who only has a high school diploma or less.

To succeed as a banker, the expectation is that you have a bachelor's degree in business or business-related fields. In addition, it's important to know foundational accounting knowledge to perform the valuation and financial modeling required on the job.

3. Location

While certain areas of the country pay well for investment bankers, others offer lower salaries due to competition from similar industries or firms like venture capital or private equity. In addition, some cities are better for jobs than others.

For Example:

New York City, is an expensive place for people to live and work, meaning entry-level jobs pay less than they would elsewhere in the country. But, again, this is because the living costs here are much higher than in Chicago.

4. Industry

Investment banking is one industry among many others that compete for talent; companies often use their measure of success (such as revenue growth) when deciding how much they will pay an employee.

That means that an investment banker in one company may be paid less than one at another because it is highly dependent on the firm's performance that year.

Compensation Structure

Most investment bankers are hired directly out of college and start with the 2-3 year analyst program. Most companies like to engage college students so they can get them as an employee when they are young, increasing their likelihood of staying with the company.

Their salary is comprised of two different parts:

1. Base

This is the standard portion of their salary. In 2022, the base wage increased to $110-125k (initially at $85-95k) for a large bulge bracket bank.

2. Bonus

This year-end compensation is typical for analysts and semi-dependent on their performance. An average bonus size ranges from $50,000 to $ 80,000, while top performers earn around $100,000.

In January of this year, many banks increased their pay so that 1st-year analysts would earn a base of $110k, and 2nd years would earn $125k.

As a result of these higher bonuses for analysts and associates, banks have opted to decrease bonus sizes slightly over 2022. During the past 1-2 years, the average percentage increase for analysts has been around 20-25%.

But what are the factors that determine the size of the bonus?

Investment Banking Bonus Size Factors

Three major factors determine the size of an investment banker's bonus.

- Firm Type: Whether the bank is Bulge Bracket, Middle Market, or Elite Boutique

- Team Performance: How did the product/coverage group perform over the past year

- Bank Performance: Total Revenue and Overall Deal Count

Although the type of bank, team performance, and overall firm performance play a role in a banker's bonus size, the ultimate factor is their performance.

The top performers usually get 100% of their base as an incentive bonus, while the lowest-performing analysts will get around 60-70% of their base pay. Therefore, it's important to be placed within the top or middle-performing sector if you seek promotion and stay with the company.

If you're placed within the lowest-performing group, you may need to up your performance if you want a promotion soon. Thus, an analyst's performance is the most important factor influencing their career advancements at the firm.

Firm Type

There are three main types of investment banks. Bulge bracket banks work on multi-billion dollar deals and have other product groups like sales and trading, commercial banking services, and asset management (for a select few).

The second type is the elite boutiques, which work on equally large deals, but focus solely on M&A advisory services (e.g., Evercore, Lazard, and Guggenheim).

Lastly, others are classified as middle market banks, which tend to work on smaller deals worth around $500 million and offer M&A advisory, debt, and equity services.

Let's discuss the differences in compensation at each of these types of firms:

- Bulge Bracket (BB) The base compensation tends to be the same as boutique banks, with bonuses varying based on the above factors. Some examples of BB banks include Goldman Sachs, JP Morgan, Morgan Stanley, Deutsche Bank, etc.

- Elite Boutique Base compensation is around 100k for analysts, with some boutiques raising their payments further. For example, Centerview Partners went up to pay $130k for first-year analysts.

They pay a larger base because they utilize a greater percentage of the deal fees to pay their employees. The bonuses tend to be the same as BB Banks. Some examples of elite boutiques include Evercore, Lazard, PJT, and Moelis & Co.

- Middle Market These firms tend to pay a little lower but remain within the competitive range to recruit college graduates. To balance out this slight reduction in pay, middle-market firms offer their employees better hours and work-life balance.

Some examples include RBC Capital markets, Jefferies, Macquarie, and KeyBanc.

Team Performance

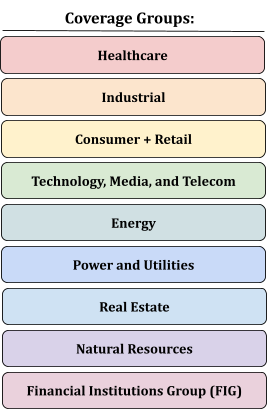

Investment banks organize their groups into coverage, which refers to specific industries.

This is a typical list of coverage groups; however, each investment bank may have its unique list of coverage groups. As an investment banker, you work closely with your group members on various deals.

When determining which group is best for you, think about the types of companies you like working with and which industry they fall into. For example, if you like following retail companies' financial trends, then the consumer and retail coverage group may be best for you.

Each coverage group competes with other firms on how many deals get closed in each industry within the year.

So, for example, if an analyst within the Telecom group manages to close many deals, thereby bringing in a lot of revenue to the bank, the bonus size for that group will be larger than for other coverage groups.

Bank Performance

Every year-end, investment banks set aside a specific percentage of revenue earned for employee bonuses. The better the firm does, the larger the bonus pool will be. However, if a firm didn't close a lot of deals that year, they have to decide to cut bonuses.

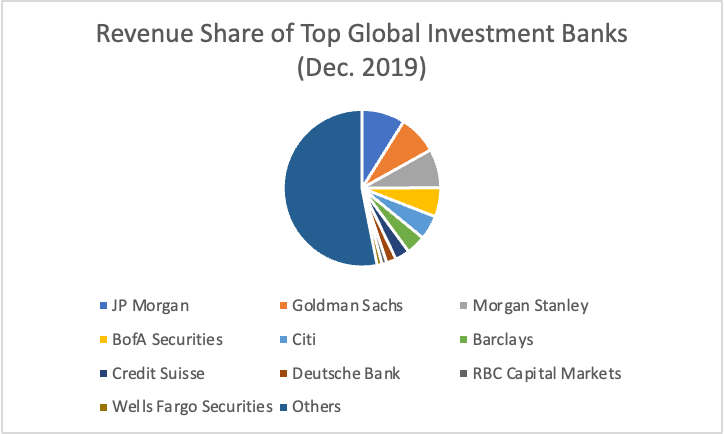

Above is a diagram of the top investment banks worldwide and their market share in the global investment banking industry. The data is taken from Mordor Intelligence, which provides market research information in consulting and banking.

As one can see, it's a very diversified industry with no single bank monopoly. This suggests that there are a lot of banks with successful analyst programs that are all within the same realm of competitiveness.

Moreover, this graph only includes the bulge and a few middle market banks, as the elite boutiques are not publicly traded. Thus, their financial information is private.

2023 Projected Bonus Size Based on Industry

Johnson Associates, a compensation analysis company, predicts a year-end bonus decrease. M&A deals have slowed because of a weak market and unsteady economic outlook, along with drastic declines in equity capital markets.

This incentive decrease is likely to continue into 2023, and inflation will put a huge damper on the actual value of the bonuses.

Because banks are cutting down on hiring new workers after the 2021 boom, headcounts are lowering within financial services.

However, retaining top talent has grown difficult, as people have the same 2021 market-level expectations. Thus, many banks are raising the base salary by 5% to keep this talent.

Plus, with the new trend of analysts leaving investment banks for private equity, banks must try to retain their talent. Thus, they must attract employees through higher pay, lower working hours, or other added perks.

Hierarchy & Typical Compensation In Investment Banking

After completing the analyst program, most employees opt for private equity because of the slightly better work-life balance for similar pay.

As most investment banks struggle to retain employees after the analyst stage, they seek to add incentives by increasing pay and decreasing the hours slightly.

- Associate: An Associate at a bank is a role typically achieved after two years of experience. They handle financial modeling, data analysis, and client engagement, assisting in the preparation of pitch books and attending client meetings. Associates typically earn around $250,000+ in compensation.

- Vice President: The next step after Associate is Vice President, whose two main focuses are maintaining client relationships and preparing pitch books. One must have the necessary social skills and analytical expertise to succeed in this role. This is why it can be difficult to transition from a technical-focused associate role to VP. In addition, the compensation for VPs can make upwards of $500k.

- Managing Director: This is the highest role at investment banks. They are responsible for the day-to-day operations of their product/coverage groups and report directly to C-Suite executives.

The information with a textual representation of the Investment Banking Career Hierarchy table you're looking for is below. Please note that specific compensation figures can vary widely based on factors such as the bank's size, location, and market conditions.

However, here is a general idea of the hierarchy and typical compensation associated with each role in Investment Banking:

| Role | Compensation | Bonus Range | Years to the next role | Responsibilities |

|---|---|---|---|---|

| Intern/Analyst | $85,000 - $125,000 | $50,000 - $80,000 | 2-3 years | Financial analysis, modeling, data collection, and research. |

| Associate | $150,000 - $250,000 | $80,000 - $150,000 | 2-3 years | Supporting senior bankers, client interactions, and deal execution. |

| Vice President (VP | $250,000 - $350,000 | $150,000 - $250,000 | 3-4 years | Leading deal teams, client management, and strategy development. |

| Director/Executive Director | $350,000 - $500,000 | $200,000 - $400,000 | 3-5 years | Overseeing multiple transactions, business development, and team management. |

| Managing Director (MD) | $500,000+ | $300,000 - $1,000,000+ | Varies | Firm leadership, client relationships, and strategic decision-making. |

Please keep in mind that these figures are approximate and can significantly change based on your geographic location and the specific investment bank you work for.

Additionally, the years to transition to the next role can vary depending on individual performance and opportunities within the organization. It's also important to note that senior roles like Managing Director may not have a fixed time frame for promotion, as they are often based on merit and experience.

Researched and authored by Sneha Srikanth | LinkedIn

Reviewed and Edited by Raghav Dharmarajan

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?