How would you assess my odd of breaking in to an FX Desk?

Good Morning to All:

I am currently taking a year off of school to attempt to become a prop trader through the Forex evaluation model industry (This is not a real prop shop as you know them. You trade SPOT FX and Commodities on a virtual capital account and if you make 13% return they will pay you 90% of excess return after that 13%), a shadow industry considered to be gambling by most real prop trader. I am making this post because it is not going well (3% drawdown on 2 accounts, 5% on 1 and 8% on 1) and there is only 60% of the year left and I want to consider my options because I need to know what I should do if this does not work out. I have delusions of grandeur but not delusional enough to not know when something is not working.

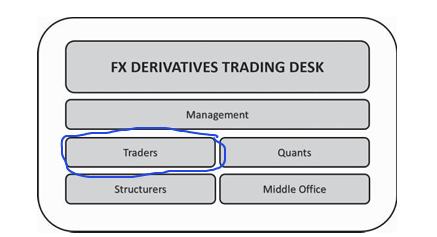

I want to work in Foreign Exchange on a desk that deals with options/forwards/futures. This is my passion and has been for many year and I will not compromise on it. I am not from a target school BBA in Finance (should have done Math SMH) and my GPA is average, above 3 but nothing super impressive, I currently live in Western Africa and do not hold a work authorization for US, UK etc. A bit about myself I have read FX Derivatives Trader school and the Art of currency trading from which most of my understanding of the industry comes from. I have also read many different books about systematic trading (mostly for my own trading), I have been studying Probability Theory+ Bayesian Statistics and Calculus 2+3+4, I think that math is probably my weakest skill which is why I am working on it every day. Conversely I am fairly good at Frequentist Statistics and can perform most basic level statistical analysis I am also studying this more for signal processing purposes. I am nothing special as a coder but I have coded more then one algorithmic trading strategy nothing quantitative that involves timeseries analysis or high level statistic but systematic trading systems built on a combination of lagging indicators and Technical analysis with C++. I can use R and python at average level.

I'm confident that most of the discretionary trading and strategy development is useless as Market Making roles have a different function then directional betting, but I would consider them the most key things on my resume so I mention them. Further I am confident with 3-4 more months of prep and studying I can pass nearly any technical interview. Self-study is not very common from what I understand but I much prefer self-study and project based learning. If I were to answer why I did poorly in school, I would say that I was doing pretty well for the first 2 years but I wanted to do more, I added a minor that I failed at, and then I just lost my mind, I was stupid and disregarded things that I should have paid attention to and then life happened and I gave up on myself sadly this also happened in my internship after my job and I failed at that to. A side effect of not learning how to fail and how to recover from a failing state.

If possible I am looking for the answers to these specific questions What is the path that I should take? Would applying through traditional routes lead any results greater then 50% probability or less then? Should I go back to school to get a master degree or can I do without, I would probably be getting my masters in the US at a non-target. Any advice that you think is worth adding is also appreciated. Ideally I want the job I circled in blue as a junior, but understand if it is impossible to get at entry level where would I apply to work towards that in a year or so? Thank you for taking the time to read and giving feedback.

The only sidenote I want to add is when I was still in university, I had a temp job in fidelity shareholder operations and I spoke to someone on their FX Desk in Chicago to network he told me that if I played my cards right it could be possible get in a junior role in 2-3 years depending on how well I do my current job and how well I network in addition to increasing my knowledge level. This is currently my base level of expectation but wondering if there is a faster route.

Edit: I will add that I know that prop trading is an opportunity but alpha generation is hard and time consuming and if the forward test on some of my strategies have taught me anything it that this is not a job for a 24 year old me, maybe after more studying and when I am 26 it might be in the cards for me but not right now.

Sit aut non deleniti hic nihil enim. Voluptatibus ut rem in quidem. Et odit ut sed aut qui et. Harum laudantium voluptas quia soluta eum nesciunt. Omnis eveniet est excepturi ab minus rerum. Nesciunt debitis doloremque voluptatem tempore.

Perspiciatis qui nostrum sapiente delectus. Earum placeat debitis itaque est et impedit. Placeat harum voluptatem dicta voluptatem. Quod sit quia aperiam quia eos quasi.

Magni nostrum voluptas dicta perspiciatis distinctio. Necessitatibus voluptates sed aut sint. Ratione occaecati architecto qui odit.

Similique aut possimus quae repudiandae libero nesciunt qui. Autem quaerat quod et sequi minima recusandae soluta. Esse et perspiciatis exercitationem nihil vero dolores animi. Mollitia illum odio non earum voluptas unde pariatur. Est non iste delectus laborum.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...