How is our NYSE backtest results quant strategy? we made 17K% in 6 YRS!

How is our Backtest result on NYSE Wall Street?

Hello all, we have been working about algo and quant bot trading in nyse for 2 years. We would like to get your review and opinion about our backtest result.

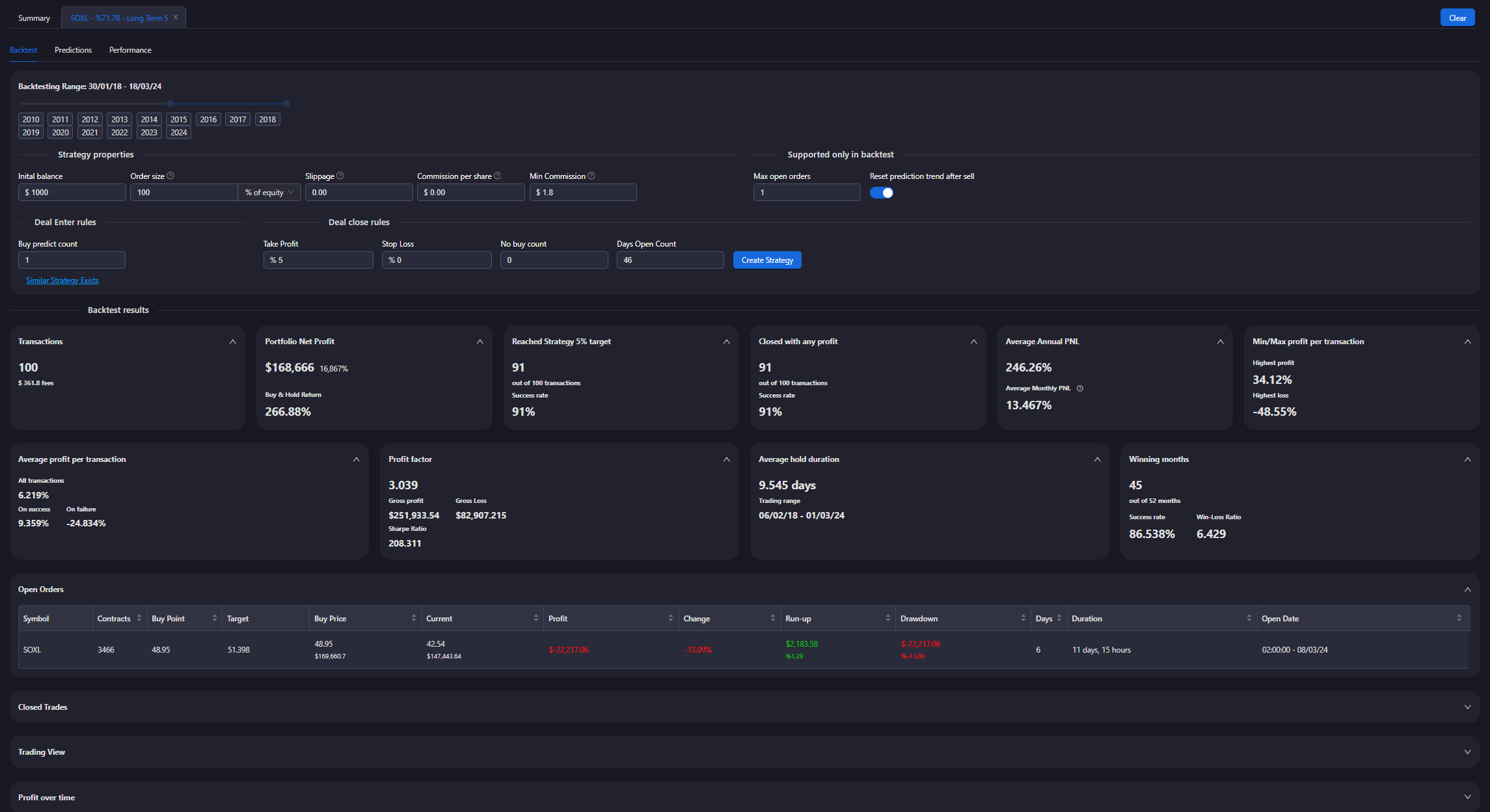

I chose 1 stock (SOXL ETF) on NYSE result that i think it's the most attractive by a few parameters that I liked and that i will start in real account to invest.

I can configure the date frames from 2010 (SOXL Inception) - Today.

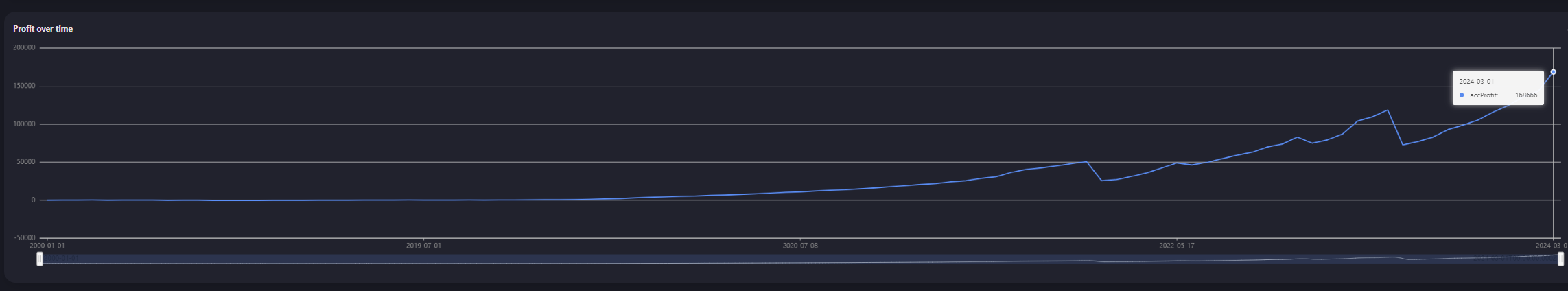

Those are the backtest results:

as you can see, we had 17K% in a 6 years of trading with 91% of success rate!

we have a few more greats strategies also with a stop loss of course but this one has a great result.

if you can give me more ideas for a better product, we would be glad!

And of course, feel free to ask more info like another dates, seeing more information results and even photos from our website platform with more graphs statics.

thanks for all!

Voluptatibus non nam ex voluptatem. Fugiat odit deleniti omnis sint at accusamus nesciunt. Atque ratione ipsum ex odio dolores odit cumque. Reiciendis laborum pariatur suscipit dolore ea fugit ut ullam.

Consequuntur reiciendis accusantium est impedit sit dolor sunt. Voluptatem in tenetur aut temporibus ullam aut qui. Sed incidunt dolor non corporis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...