MM PE (Harvest, THL, MDP etc.) vs Megafund REPE (Bain, Brookfield, TPG etc.)

as ddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddasd ads

as ddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddddasd ads

Career Resources

MM PE with no hesitation. Broader and more marketable skillset, better MBA placement, generally higher pay. Most importantly, you can go MM PE --> REPE later but you can't go REPE --> PE.

Appreciate the answer. I have a couple questions though.

What's your source on the better pay? I'm almost positive that cash comp is higher for MF REPE, as I know MF REPE and MF Corp get the same cash comp. And carry depends on the particular fund and performance.

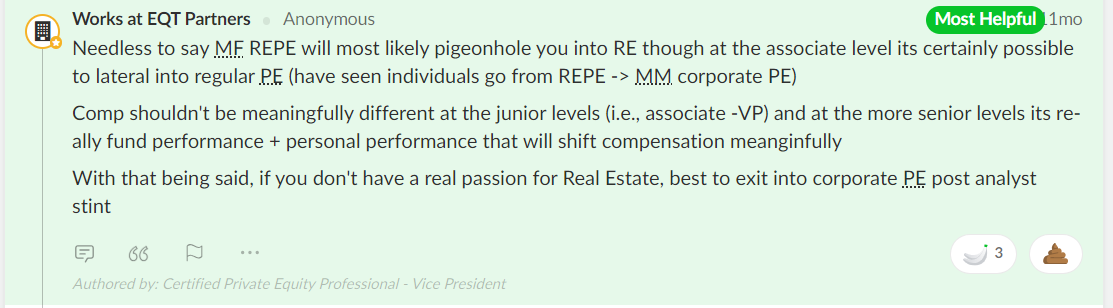

Also why do you say you can't go REPE to PE? This VP from EQT said he's seen people do it:

Literally anything is possible. They're an outlier, you have no way of knowing what their circumstances were, who they knew, what differentiated them, etc. This career path is about optimizing your opportunities. Why choose to put yourself at a disadvantage in an increasingly competitive job market? Everything the prior commenter said about marketable skill sets, MBA opportunities, and compensation is true so MM PE > MF REPE in most cases. If you're passionate about REPE then do that, but if you were you probably wouldn't be asking this question.

I have no commentary on pay.

I think what we are all saying is that it may be possible to lateral at the associate level (obviously depends on a candidate's background). It is by no means guaranteed. If you have offers for both seats, I would also take corporate or see if there are seats that are more special situations-oriented to scratch a similar itch.

If the itch is just to have a MF on your resume, then by all means take the MF role. Just don't expect to have much mobility to corporate beyond senior associate.

yeah I understand. I'm not too concerned about mobility, the main thing for me is pay long-term. Just trying to maximize my earnings potential. I know for sure that BX pays more than MM (as they raised a 30BN repe fund) and Brookfield too, as they have a 17Bn repe fund. But outside of that curious what the comp difference are.

Essentially, I'm an incoming an1 at a top REGL group at a BB, and trying to see if I should target MF REPE or MM PE, as I know UMM corporate will be tough

If you're focused on W-2 income for your second job as a key determinant of a significant portion of your career, then I would suggest you reassess your priorities. The asset classes, skills, etc. are so different that even a marginal $200k in W-2 would give me pause if I weren't totally committed to a career in REPE.

Stepping back a bit, I would hypothesize that the expected value of a MM corporate seat over a career somewhat exceeds a MF RE seat because corporate would help you build skills in investing, structuring, running a business, managing complex stakeholder bases, making operational changes (e.g., starting a new vertical, shutting down a division), and leading transformational/turnaround efforts (among other things). MF RE will definitely provide you more advanced structuring knowledge and ample experience with super complex waterfalls, but the TAM of those skills is going to be perceived as limited relative to a corporate seat.

As posters above iterated, pay is going to be highest in the asset class with the highest returns. Go read the research, but PE returns consistently outperforms real estate (example article (haven't reviewed their sources)) - https://www.moonfare.com/blog/private-equity-vs-real-estate)). Sure you can say that MF groups have standardized pay, but do they really? Maybe base is standardized (maybe), but I'm willing to put my own pay on the line that bonus and carry is not standardized across groups (especially mid-career+) with very different expectations for work hours, returns, risk profile, etc. These funds are economic machines and far more meritocratic than socialist leaning.

Now to compare MF REPE vs. MM PE comp, I'm sure there's literature available, but nothing is going to be perfect. There's multiple comp surveys available for PE (H&S, etc.) that are directionally accurate. You can also ask recruiters' input, particularly those with REPE clients. At some point, you just need to decide what you actually think is interesting. If you're picking squarely based on comp, with no interest in these fields, I assure you that you'll be challenged to actually "maximize comp" because that requires actually being successful and rising within these careers, which is really hard if you're grinding away late nights and weekends at something that you don't even like.

Tough situation to be in.

Having worked in both in real estate and in private equity, I would think about what your goals are long term.

MM PE requires more of strategic mind. You're going to be working on fewer deals, but thinking about how to grow the companies strategically.

MF REPE is more of a volume game. You'll be working on more deals that are less complex, less potential returns compared to MM PE , but you make money on fees.

If you want to go entrepreneurial one day (E.g - start a fund), I would argue that in this current environment, new MMPE firms are facing a lot of competition given all the dry powder and fewer deals.

There's always deals in real estate and its way easier to raise capital comparatively.

If it were me, I would do REPE, but thats my personality. I rather do a higher volume of "easier" deals than deal with the headaches of investing and managing MM PE portcos.

Don't be so concerned on comp - the money will come if you're good at what you do.

Appreciate it. How/why is it easier to raise capital in RE?

Capital will be easier to attract if you’re good at something.

If you’re more passionate about real estate, do that. If you want more of a general experience, do private equity.

The way the market is right now may be totally different when you are my age, so do what interests you more.

I would reach out to alumni from your school in each respective industry and ask for their perspectives.

Having worked at one of those MM PEs I would say take the MF REPE. I will not take follow up questions, if you read the existing posts on those firms you'll have your answers.

That said, if you want to do corporate PE, you should go into corporate PE, full stop. Don't overengineer your career or think about edge cases; if you want to do corp PE, do corp PE.

MF REPE without question. Do you really think in a long term earnings comparison, your average MM PE Partner’s gonna outperform a Brookfield REPE Partner? Give me a break

What's worth flagging is that even within REPE, a coupe of MFs (BX, KKR sometimes, some regional teams) do it very uniquely to the point it's practically just corporate PE with extra (quite interesting) steps. Example BX's investments in Merlin, QTS, Hilton, and build up of Mileway etc. If you're able to find a seat in a MF REPE team where you can play a role in building a new platform like that - that's an amazing way to start your career with quite varied exits.

Great point. One of my friends from undergrad (HYP) when to BXPE out of college and is now about to join Viking

Depends if its Bain vs TPG. Bain is a single asset buyer vs TPG who does RE buyouts. Two completely different skill sets will be learned.

Do you want to an asset level buyer? Yes? then go to Bain

Do you want to stay in the institutional space? Yes? go to TPG

I would do TPG > MM PE > Bain

Quod voluptate voluptas quia fugiat dolor tempora nemo. Quia reiciendis voluptas sunt et cum esse. Corrupti ratione quo quod. Beatae laudantium voluptatem ducimus quod. Corrupti adipisci tempora magnam.

Minus et eaque assumenda doloremque et. Occaecati iure quia hic rem.

Necessitatibus unde omnis incidunt sed esse id rerum. Autem id maxime sunt incidunt.

Earum in molestiae ut et et accusantium. Eum voluptas aliquid non neque voluptatem. Voluptas qui earum earum. Ad unde adipisci et quisquam dolore magni nostrum. Aut est odit qui. Ipsam nihil eius culpa nesciunt. Modi odit nulla adipisci quisquam animi fuga.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...