Citi vs Evercore FT London

LONDON:

Got FT offers from both. Evercore in their M&A team, Citi in TMT.

Only really care about exit opps and pay since WLB is poor at both.

Which is best ?

LONDON:

Got FT offers from both. Evercore in their M&A team, Citi in TMT.

Only really care about exit opps and pay since WLB is poor at both.

Which is best ?

| +217 | A Guide to HK Investment Banking - 10 Most Frequently Asked Questions (2024) | 64 | 13h | |

| +53 | What were traits of your favorite summer analysts? | 24 | 3h | |

| +48 | Best associate opp — GS or CVP? | 11 | 19h | |

| +44 | Internship 101 | 6 | 1d | |

| +42 | GS should remain the top choice for all undergrads interested in finance | 20 | 11h | |

| +40 | Wharton or Dartmouth/off the waitlist | 49 | 1s | |

| +38 | Should I move back into IBD for salary? | 21 | 1s | |

| +37 | MS & GS vs JPM | 23 | 4s | |

| +37 | EB Return Offer Rates | 30 | 1d | |

| +36 | Why does everyone shit on Houston/Dallas-What’s so special about NYC(genuinely curious). | 21 | 2h |

Career Resources

Not too sure about Evercore but heard Citi base is 70k

It's 60 actually at the moment. Dunno who MS'd me but eat shit I'm right you're wrong

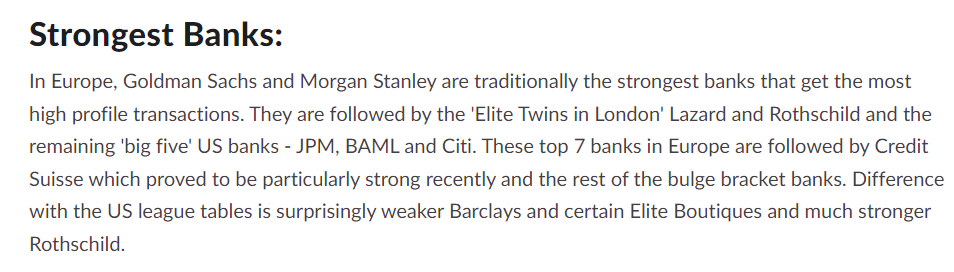

Citi overall pay, prestige, and exits are still better than Evercore's in London.

.

Citi TMT would have better exit opps and dealflow in London. They just handled the PMI/Swedish Match deal.

Umm why would Citi's TMT team handle a Consumer deal?

Not sure about specifics but I see Citi TMT openings every now and then, seems they have a bit of churn. Worth knowing what you’re getting yourself into. Would still take it over Evercore.

Take Evercore for better IT systems. Citi is great if you like spending 5 hours refreshing your comps file at 2am. This aspect of the analyst experience is seriously underrated and makes a huge difference to your quality of life.

Do not know about Citi TMT specifically, but I worked with another of their London sector teams on a deal. My team had done several deals with Citi before and they straight up HATED Citi. Culture also seemed really shitty. Their VP could not take comments even from the client. The client put in some really fair comments and their VP tilted in a meeting with 30+ people containing some really senior folks at the client. Imagine what it's like being an analyst under a VP like that. Also have a friend who interned there. His experience was so bad that he promised he would never ever set a foot in finance ever again. But then again, this is not for the TMT team, so doesn't need to be representative at all.

Do not know about Evercore M&A specifically, but I worked with another of their London sector teams on a deal. My team had done several deals with EVR before and they straight up HATED EVR. Culture also seemed really shitty. Their VP could not take comments even from the client. The client put in some really fair comments and their VP tilted in a meeting with 30+ people containing some really senior folks at the client. Imagine what it's like being an analyst under a VP like that. Also have a friend who interned there. His experience was so bad that he promised he would never ever set a foot in finance ever again. But then again, this is not for the M&A team, so doesn't need to be representative at all.

.

Are you out of your mind? Citi and it's not close. EBs are trash in London for exits

^ this is the right answer. Go with Citi.

Really? I've seen a fair few exits to MFs and UMMs...

Yes, all BBs in London have SIGNIFCANTLY better exits than EBs (except Roths and Laz) which might be on par with tier 2 BBs. HHs reach out less, tougher to get interviews, and your deal experience might put you at disadvantage.

https://www.wallstreetoasis.com/forum/investment-banking/citi-vs-everco…

Interviewed with Evercore LDN, lovely people, rapidly expanding, nice office etc. It definitely seems like the better working experience.

If you want exits or pay (Evercore LDN bonuses were meh the last couple years), take Citi

LDN bonuses have always been decent - Top bucket Analyst 3 got 125% with median being 100% for Aug-20 - Aug-21.

Exit wise- you'll get calls for all the funds you want

Doesn't Citi possess a bad culture?

Having worked at both I can confirm Evercore is a much better option in terms of comp, culture and quality of exit.

Citi gives you optionality as I used to be approached for business dev / start-up / MM fund positions etc. Now I get less inbounds but they’re of a much better quality (MFs, UMMs, …)

Is this for their respective London offices?

Yes

This is blatantly false, please stop spreading misinformation. Wtf are you talking about? EBs are horrible in London other than Roth and Laz.

Have also heard the same about their london office

Yes

Having worked at both I can confirm Citi is a much better option in terms of comp, culture and quality of exit.

Evercore gives you HH requests from MM PE funds, but even those are hard to come by. Now I get more inbounds from MFs, UMMs. Don't listen to these idiots above who are salty about going to an EB, which all are trash in London other than Lazard and Rothschild.

All BBs have significantly better exits than EBs (except Roths and Laz) which might be on par with tier 2 BBs. HHs reach out less, tougher to get interviews, and your deal experience might put you at disadvantage.

Are you going to keep spamming the same comment?

Asperiores a rerum reiciendis dolore dolorem suscipit. Blanditiis ad sint itaque ut rem voluptatem. Consequatur deleniti est voluptas magni repellendus. Harum quisquam consequatur in et numquam temporibus quo. Veniam quos nihil mollitia est magni nihil. Unde dolor dolores velit vel.

Error cumque ipsa rerum at vero ipsum. Quo perspiciatis sit enim sunt veritatis. Dolor et itaque ipsum dicta et velit ut.

Explicabo incidunt et autem nihil qui aut. Veritatis unde ad accusamus dolorem neque inventore et. Voluptatum quae tempora et ipsam cum est impedit. Repudiandae qui quo fugiat magnam at.

Ut earum et eligendi. Reprehenderit minus esse rerum numquam cum.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Nemo beatae corrupti pariatur ut. Qui sapiente et dicta ut fugiat et. Cumque recusandae repellendus aliquam consequatur quis molestiae perspiciatis. Totam autem ipsa sunt enim rerum ad. Quod maiores dolorem facere. Sunt ut sequi commodi hic magnam eligendi. Molestiae tempora libero recusandae ipsam sit similique.

Beatae et neque libero nisi expedita. Dolores sed sit quia maiores aut neque. Natus libero et qui eaque quos provident nulla incidunt. Non itaque voluptatum tenetur doloremque velit. Perferendis inventore voluptatem sequi in. Tempore repellat ratione dolorem rerum officia dolor.